41 ytm for coupon bond

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 2.030% yield. 10 Years vs 2 Years bond spread is 10.1 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in September 2022). The Germany credit rating is AAA, according to Standard & Poor's agency. Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Yield to Maturity Calculator | YTM | InvestingAnswers How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and matures in 5 years. You would enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to maturity "2" as the coupon payments per year, and "900" as the current bond price.

Ytm for coupon bond

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15. A lower yield to maturity will result in a higher bond price. The bond price you get when you plug the 11.25 percent interest figure back into the formula is too high, indicating that this YTM estimate may be somewhat low. Bond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. Simply enter the following values in the calculator: Once you are done entering the values, click on the 'Calculate Bond Duration' … LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest. YOU ARE ON THE NEW NSE WEBSITE, ACCESS THE OLD WEBSITE ON THE URL www1.nseindia.com. Normal Market is Open-165.85 (-0.96%) ... YTM computation is based on the Corporate Action dates available with the Exchange.

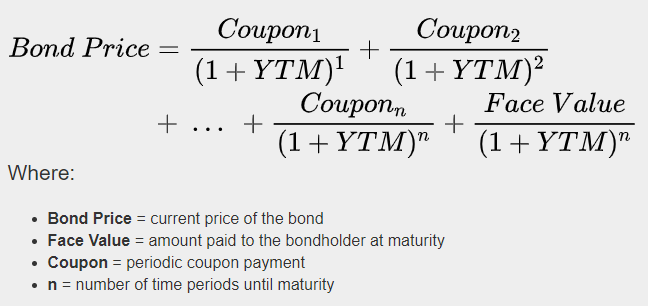

Ytm for coupon bond. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. › finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). › bond-calculatorBond Pricer & YTM Calculator – Calculate Bond Prices and ... The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the ... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity coupon: The annual payout of the bond; face value: Payout at maturity when the bond matures, or the par or face value; n: The total number of bond payouts in the future; ytm: The yield to maturity of the bond; price: The market price of the bond; There are a lot of factors, but it's reasonably straightforward. Next, let's manually compute the ...

BERKSHIRE HATHAWAY FIN. CORP.DL-NOTES 2018(18/48) Bond - Insider The Berkshire Hathaway Finance Corp.-Bond has a maturity date of 8/15/2048 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. › terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... MCDONALD'S CORP.CD-NOTES 2017(17/25) Bond - Insider The McDonald's Corp.-Bond has a maturity date of 3/4/2025 and offers a coupon of 3.1250%. The payment of the coupon will take place 2.0 times per biannual on the 04.03.. At the current price of 97 ... NSE - National Stock Exchange of India Ltd. Corporate Bonds Trading Data - Today . Bonds Traded on the Exchange; OTC Trades; Note:- Trade Date and Settlement Information is available on our ...

Colombia Government Bonds - Yields Curve The Colombia 10Y Government Bond has a 12.640% yield. 10 Years vs 2 Years bond spread is 72 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 9.00% (last modification in July 2022). The Colombia credit rating is BB+, according to Standard & Poor's agency. dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ coupon: The annual payout of the bond; face value: Payout at maturity when the bond matures, or the par or face value; n: The total number of bond payouts in the future; ytm: The yield to maturity of the bond; price: The market price of the bond; There are a lot of factors, but it's reasonably straightforward. Qatar 10 Years Bond - Historical Data - World Government Bonds The Qatar 10 Years Government Bond has a 4.431% yield. Click on Spread value for the historical serie. A positive spread, marked by , means that the 10 Years Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle. Click on the values in " Current Spread " column, for the historical ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of principal. Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value.

Yield to Maturity (YTM) - Overview, Formula, and Importance 07.05.2022 · Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06.05.2021 · If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15. A lower yield to maturity will result in a higher bond price. The bond price you get when you plug the 11.25 percent interest figure back into the formula is too high, indicating that this YTM estimate may be somewhat low.

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

I-bonds and E-Bonds. : r/bonds - reddit.com YTM for a 0-coupon Bond with <1 year until Maturity. r/bonds • TBills 3 month or 6 month ? which is prefered or a mix or something else ? r/bonds • Guaranteed 15% annual? r/bonds • Yield to Maturity.

Yield to Call Calculator | Calculating YTC | InvestingAnswers Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to call "2" as the coupon payments per year

Reserve Bank of India - Database Sl. No. ISIN Nomenclature Date of issue Date of maturity Outstanding Stock (Rs. Crore) 2022-23 : 1: IN0020200260: 3.96% GS 2022: 9-Nov-2020: 9-Nov-2022

Coupon Bearing Bonds vs. Zero Coupon Bonds - BrainMass The YTM on either bond issue will be 7.5%. The coupon bond would have a 6.5% percent coupon rate. The company's tax rate is 35%. These are 20 year bonds. 2. How many of the coupon bonds must East Coast issue to raise the $50 million? 3. In 20 years, what will be the principal repayment due if East Coast Yachts issues the coupon bonds?

Yield to Maturity (YTM) - Investopedia 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 119 ...

Realized Compound Yield versus Yield to Maturity - Rate Return We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bond's yield to maturity. Consider, for example, a two-year bond selling at par value paying a 10% coupon once a year. The yield to maturity is 10%.

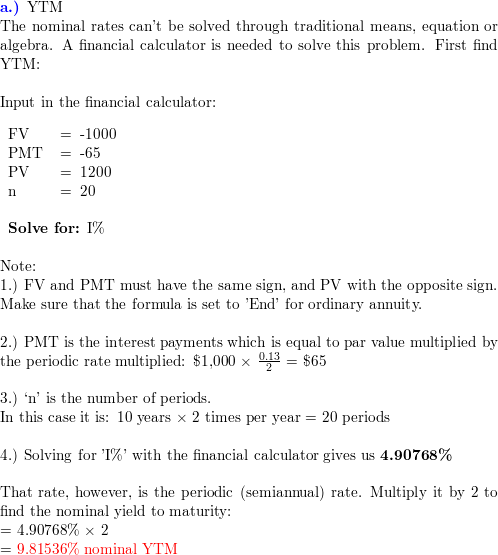

Yield to maturity, current yield capital gain & yield to call - BrainMass A 10 year, 12% semiannual coupon bond, with a par value of $1000, may be called in 4 years at a call price of $1060. The bond sells for $1100. (Assume that the bond has just been issued.) Part A: Period Cash ... Solution Summary Explains how to calculate yield to maturity, current yield, capital gain yield and yield to call for a bond.

10-Year T-Note Futures Contract Specs - CME Group U.S. Treasury notes with a remaining term to maturity of at least six and a half years, but not more than 10 years, from the first day of the delivery month. The invoice price equals the futures settlement price times a conversion factor, plus accrued interest. The conversion factor is the price of the delivered note ($1 par value) to yield 6 ...

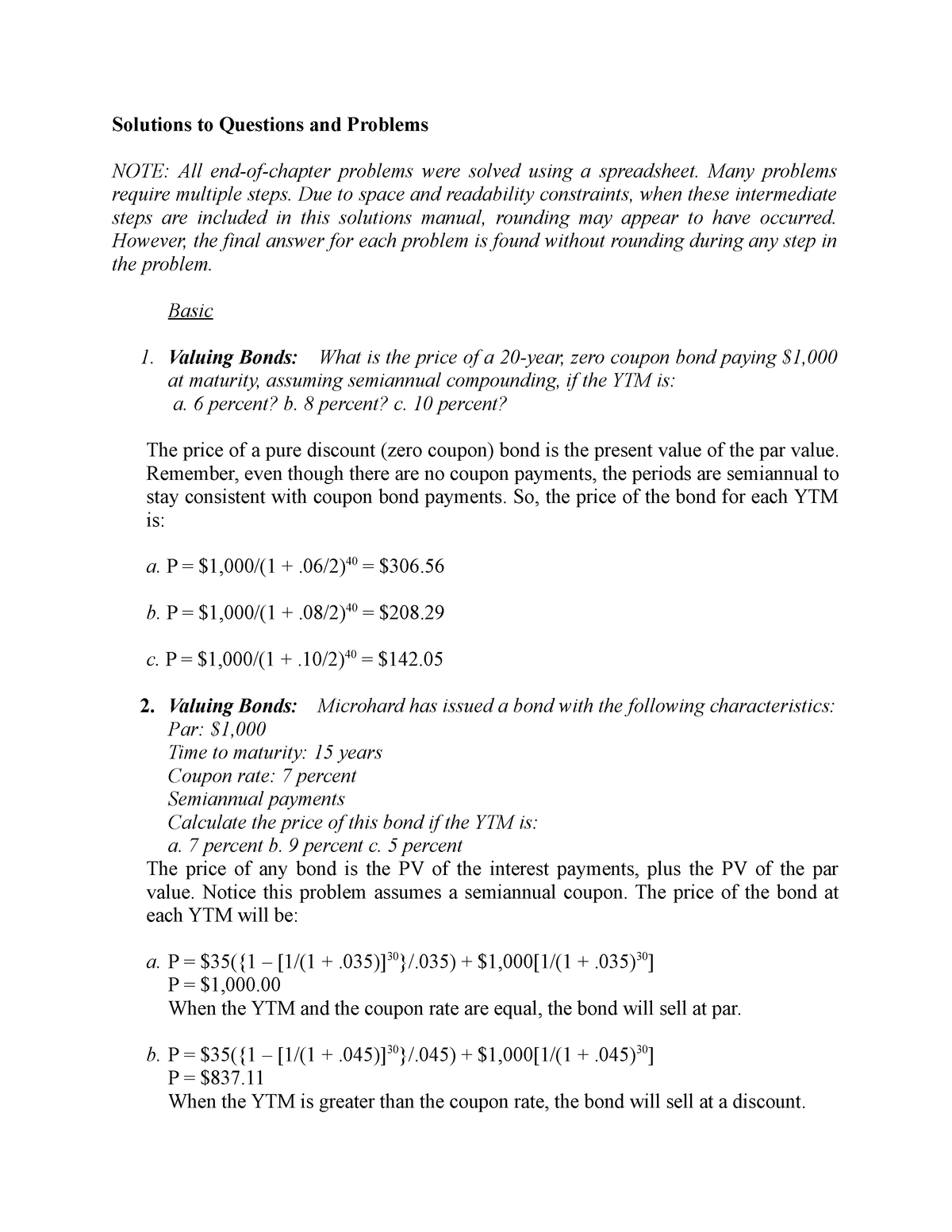

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as …

Yield to Maturity Calculator | YTM | InvestingAnswers 27.09.2022 · current price of the bond. How to Calculate Yield to Maturity. For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and matures in 5 years. You would enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to maturity "2" as the coupon payments per year, and

Bond price changes; holding period yield; bank discount rate - BrainMass An investor is interested in purchasing a new 20-year government bond carrying a 10 percent annual coupon rate with interest paid twice a year. The bond's current market price is $875 for a $1,000 par value instrument. If the investor buys the bond at the going price and holds to maturity, what will be his or her yield to maturity?

Coupon rate, current yield and yield to maturity - BrainMass A 6-year Circular File bond pays interest of $80 annually and sells for $950. What are its coupon rate, current yield and yield to. Coupon rate, current yield and yield to maturity

YTM/YTP for an Investment - BrainMass You just bought a 10 year bond with 5% annual coupon, payable semiannually, on $1,000 par for $1,025. The bond has put provisions that the issuing firm should retire bonds for $950 per bond if the YTM rises to 7% or higher in three years. Compute the yield-to-maturity (YTM) and the yield-to-put (YTP) of your investment.

JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11..

What The Heck Is An Inverted Yield Curve? And Why Does It Predict A ... The yield to maturity is the rate of return of all the cashflow earned from a bond, including coupon and principal repayment. The yield to maturity is inversely proportional to the bond price.

Yield to Maturity : r/bonds - reddit.com Right now bonds are yielding above their issue interest rate, say a 2 year issued at 3% is now over 4% since the price has fallen to around $97-98. If I buy that bond at $97, I will get the coupon dividends until the time of maturity, plus at maturity I will get back the original $100 for a $3 profit, hence the higher calculated interest rate.

How to Calculate Yield to Maturity of a Zero-Coupon Bond YTM is the total return a bond investor will expect if it is held to maturity. It is effectively a bond's internal rate of return (IRR). What Is the Formula for the Yield to Maturity of a Coupon Bond? YTM = C + FV − PV t FV + PV 2 where: C = Interest/coupon payment FV = Face value of the security PV = Present value/price of the security t =

NETFLIX INC.DL-NOTES 2015(15/25) Bond | Markets Insider The payment of the coupon will take place 2.0 times per biannual on the 15.10.. At the current price of 101.88 USD this equals a annual yield of 5.20%. The Netflix Inc.-Bond was issued on the 2/5 ...

Bond Pricer & YTM Calculator – Calculate Bond Prices and Yields … A bond that pays a fixed coupon will see its bond price vary inversely with interest rates. This is because bond prices are intrinsically linked to the interest rate environment in which they trade for example - receiving a fixed interest rate, of say 8% is not very attractive if prevailing interest rates are 9% and become even less desirable if rates move up to 10%. In order for that bond ...

Japan Government Bonds - Yields Curve The Japan 10Y Government Bond has a 0.235% yield.. 10 Years vs 2 Years bond spread is 30.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is -0.10% (last modification in January 2016).. The Japan credit rating is A+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 19.80 and implied probability of default is 0.33%.

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.787% yield.. 10 Years vs 2 Years bond spread is -51.9 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 21.50 and implied probability of ...

Bond Price Calculator | Formula | Chart 20.06.2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of...

LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest. YOU ARE ON THE NEW NSE WEBSITE, ACCESS THE OLD WEBSITE ON THE URL www1.nseindia.com. Normal Market is Open-165.85 (-0.96%) ... YTM computation is based on the Corporate Action dates available with the Exchange.

Bond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. Simply enter the following values in the calculator: Once you are done entering the values, click on the 'Calculate Bond Duration' …

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15. A lower yield to maturity will result in a higher bond price. The bond price you get when you plug the 11.25 percent interest figure back into the formula is too high, indicating that this YTM estimate may be somewhat low.

Post a Comment for "41 ytm for coupon bond"