44 how to determine coupon rate

Publication 17 (2021), Your Federal Income Tax - IRS tax forms To determine whether you must file a return, include in your gross income any income you received abroad, including any income you can exclude under the foreign earned income exclusion. For information on special tax rules that may apply to you, see Pub. 54. It is available online and at most U.S. embassies and consulates. All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads,

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

How to determine coupon rate

Publication 463 (2021), Travel, Gift, and Car Expenses | Internal ... Standard mileage rate. For 2021, the standard mileage rate for the cost of operating your car for business use is 56 cents (0.56) ... If you temporarily travel away from your tax home, you can use this chapter to determine if you have deductible travel expenses. This chapter discusses: Credit Cards - Compare Credit Card Offers | Credit.com A lower interest rate means you will pay less money toward interest charges as you pay down the balance. Meanwhile ... Determine whether a low interest card is what you’re looking for or a card with more substantial rewards. If you’re unsure how to decide - or trying to learn about credit cards in general, our Credit.com ... Home | NextAdvisor with TIME With 2 Days to Lock in a 9.62% I Bond Rate, We Answer Your Questions 7 min read. You Can Now Earn 2.35% with a Capital One Savings Account. How to Maximize Higher Interest Rates

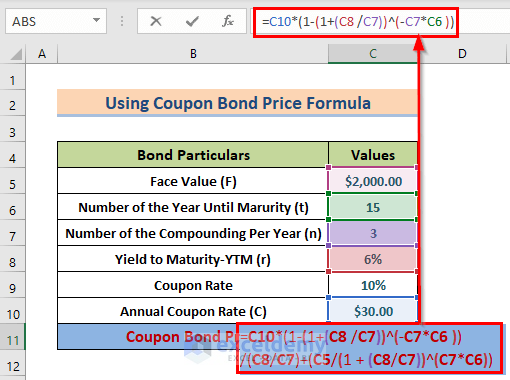

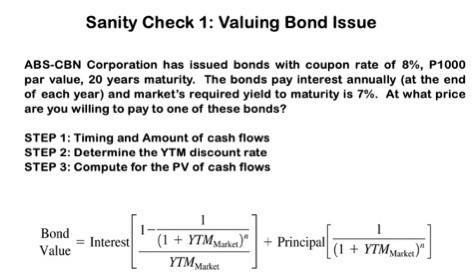

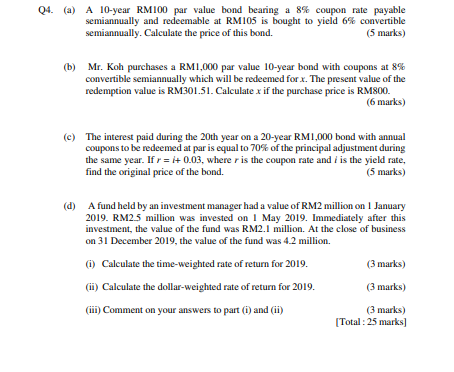

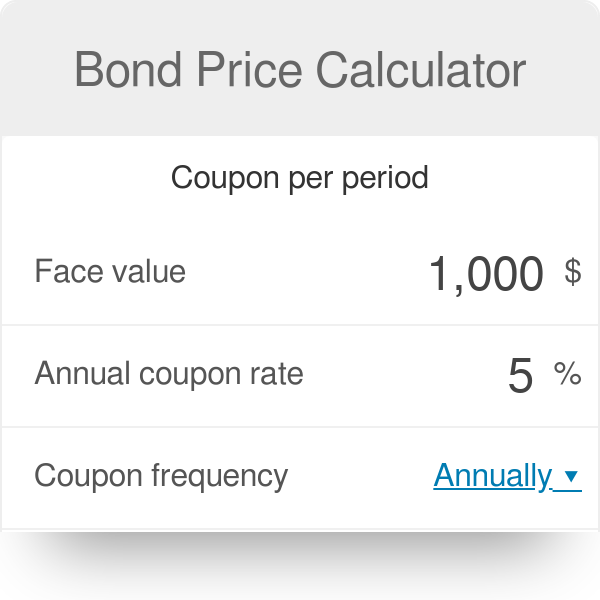

How to determine coupon rate. What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Sanctions Programs and Country Information | U.S. Department of … 21.10.2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 … Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Home | NextAdvisor with TIME With 2 Days to Lock in a 9.62% I Bond Rate, We Answer Your Questions 7 min read. You Can Now Earn 2.35% with a Capital One Savings Account. How to Maximize Higher Interest Rates Credit Cards - Compare Credit Card Offers | Credit.com A lower interest rate means you will pay less money toward interest charges as you pay down the balance. Meanwhile ... Determine whether a low interest card is what you’re looking for or a card with more substantial rewards. If you’re unsure how to decide - or trying to learn about credit cards in general, our Credit.com ... Publication 463 (2021), Travel, Gift, and Car Expenses | Internal ... Standard mileage rate. For 2021, the standard mileage rate for the cost of operating your car for business use is 56 cents (0.56) ... If you temporarily travel away from your tax home, you can use this chapter to determine if you have deductible travel expenses. This chapter discusses:

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 how to determine coupon rate"